Experience the most effective of Banking at a Wyoming Credit Union: Your Local Financial Companion

Experience the most effective of Banking at a Wyoming Credit Union: Your Local Financial Companion

Blog Article

Credit History Unions: Your Course to Better Financial

In the realm of modern-day financial, Credit history Unions stand out as a sign of personalized community-centric values and financial remedies. By cultivating a sense of belonging and prioritizing individual demands, Credit score Unions have actually redefined the financial experience.

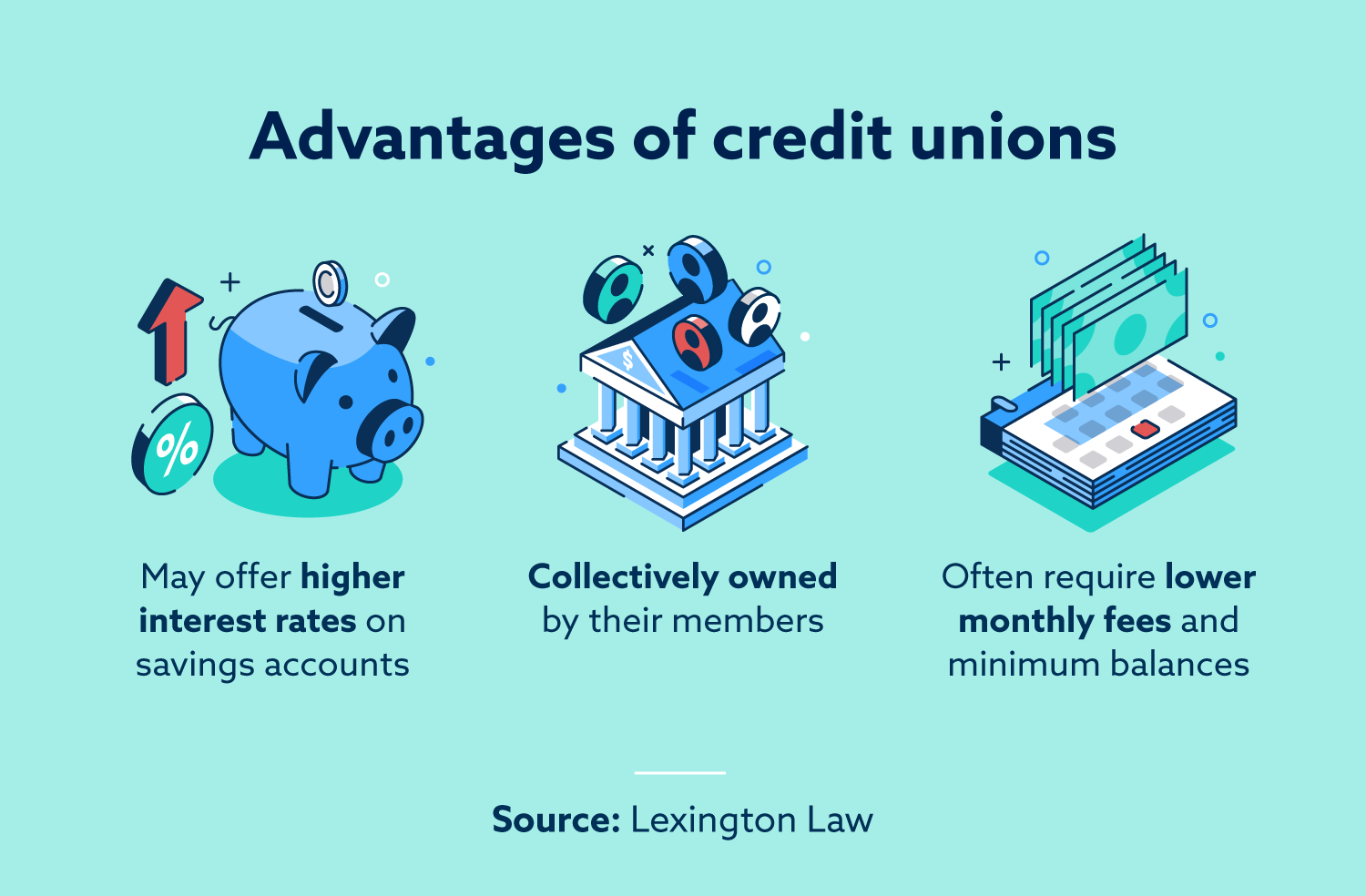

Advantages of Cooperative Credit Union

Credit history unions offer a range of benefits that set them apart from typical banks in terms of customer service and area participation. Credit rating unions are not-for-profit organizations, implying they focus on providing competitive prices on financial savings accounts, lendings, and credit history cards for their participants.

In addition, credit unions are deeply rooted in the neighborhoods they offer. They frequently take part in area outreach programs, enroller local occasions, and support charitable reasons. By fostering these connections, lending institution add to the economic growth and development of their areas.

In addition, credit report unions generally have lower fees and offer much better interest prices compared to typical banks. Members usually gain from lower car loan rates of interest, greater returns on interest-bearing accounts, and decreased or no fees for services like checking accounts or ATM withdrawals. This monetary advantage can result in significant long-lasting savings for participants.

Personalized Solution

With a focus on personalized attention and customized financial options, participants of lending institution profit from a high level of personalized service. Unlike conventional banks, lending institution prioritize constructing strong connections with their members by comprehending their distinct monetary requirements and goals. This tailored technique permits lending institution personnel to give tailored advice, referrals, and options that straighten with each member's certain scenario.

One trick facet of individualized service at credit score unions is the availability of personnel participants. Participants commonly have direct accessibility to decision-makers and monetary advisors, cultivating a much more individual and receptive banking experience. Whether a member needs support with a car loan application, economic planning, or settling an issue, lending institution personnel are easily offered to supply assistance and guidance.

Moreover, lending institution make every effort to exceed transactional communications by establishing count on and connection with their participants (Credit Unions in Wyoming). By being familiar with individuals on an individual degree, cooperative credit union can better offer their monetary demands and use tailored services that help members accomplish their objectives. This commitment to tailored solution sets lending institution apart and creates an extra valuable and engaging banking connection for members

Affordable Rates

In today's competitive economic landscape, lending institution provide members eye-catching rates that can enhance their overall financial experience. Unlike conventional financial institutions, cooperative credit union are not-for-profit organizations had by their participants, permitting them to concentrate on providing affordable prices instead of maximizing revenues. This distinct structure enables lending institution to supply reduced my blog passion prices on car loans, higher rate of interest on cost savings accounts, and fewer fees compared to several large banks.

Affordable prices are a substantial benefit for debt union members when seeking economic items such as home mortgages, auto loans, or bank card. By offering reduced rates of interest, debt unions aid members save cash in time and achieve their economic objectives a lot more successfully. Additionally, the higher passion rates on interest-bearing accounts allow members to grow their money much faster and increase their savings capacity.

Community-Focused Initiatives

Whether with contributions, sponsorships, or volunteer job, credit report unions show their dedication to making a favorable influence past simply financial solutions. These initiatives not just strengthen the bond in between the credit scores union and its participants yet also promote a feeling of uniformity and participation among area members.

Boosted Banking Experience

An Enhanced Banking Experience identifies lending institution by focusing on tailored solutions customized to satisfy the unique monetary needs of their members. Unlike standard financial institutions that commonly concentrate on earnings, credit scores unions position a solid emphasis on member contentment and economic health. This tailored strategy enables cooperative credit union to offer an array of advantages that boost the total financial experience for their participants.

One trick aspect of an Improved Financial Experience is the emphasis on structure solid relationships with members. Credit scores union team often put in the time to comprehend each member's private economic objectives and difficulties, providing tailored advice and guidance to aid them make educated decisions. This customized touch creates a sense of trust and commitment in between the lending institution and its members, fostering a long-lasting partnership.

Additionally, credit unions regularly offer competitive prices on fundings and financial savings items, assisting members save cash and achieve their monetary goals quicker. The focus on member service and satisfaction sets credit rating unions apart in the financial sector, making them a preferred selection for people seeking a much more satisfying and customized financial experience.

Final Thought

Debt unions are not-for-profit companies, suggesting they prioritize offering competitive rates on cost savings accounts, financings, and credit cards for their members.Affordable prices are a substantial benefit for credit union members when looking for economic items such as home mortgages, car fundings, or debt cards. By offering workshops, workshops, and resources on topics like budgeting, saving, and credit history structure, credit history unions proactively contribute to the monetary well-being of families and people.

These campaigns not just reinforce the bond in between the credit scores union and its members yet additionally promote a sense of uniformity and participation among community participants. By prioritizing participant satisfaction and giving customized economic options, Credit Unions show a dedication to empowering their members and constructing solid, trust-based partnerships.

Report this page